Model Foundation

In the introductory blog in our series on model risk, we stated that a clearly defined model risk management framework can significantly enhance business efficiency and output quality, resulting in sound decisions and regulatory compliance.

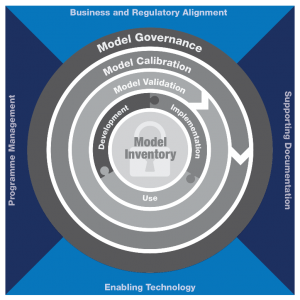

The first and most fundamental step in achieving and sustaining an effective AML model risk programme is to have a strong model foundation, which provides structure, consistency, and efficiency.

4 Essential Elements of a Strong AML Model Foundation

Source: Crowe Horwath LLP analysis

1. Business and Regulatory Alignment

Models that are not fully aligned to the business requirements of a financial institution will result in ineffective management of financial crime risk and poor outcomes. Organisations should ensure that their business requirements align to AML regulatory standards. If not, they are exposed to the risk of their model risk management framework being deemed ineffective and receiving regulatory criticisms, including up to levying AML fines and penalties.

To achieve business and regulatory alignment, financial institutions should assess models as there are changes in the business, including customer base, products and services offered, geographies serviced and distribution channels and as regulations evolve. Processes, decision-making, and risk management activities should be adapted in response to these changes.

2. Supporting Documentation

If documentation supporting the AML model risk management framework, is not in place, a regulator will assume that documentation does not exist or the governance activities are insufficient.

– Documentation is vital for all areas of model risk management, including:

– Policies and procedures,

– Model inventory and risk assessments,

– Detailed support for model development, implementation, and use,

– Periodic model validation results, and;

– Detailed calibration analyses.

3. Enabling Technology

As institutions increasingly rely on models to drive business decisions, the need grows for senior managers to establish standards for effective and efficient risk management mechanisms. Technology should be used to implement a consistent model risk management programme across the business in order to:

– Document all risk management activities consistently and effectively; and

– Enable other processes, including model risk assessment, validation, and calibration.

4. Programme Management

Model risk management is relatively new concept, ongoing and time-intensive, however it is a worthwhile investment.

It is important that those chosen to manage the AML model risk programme have the expertise and functional capabilities to execute their duties and understand the models’ use. The professionals also should have adequate influence within the financial institution, align with overall model risk management activities (including capital and credit risk models) and be given adequate resources to manage the programme.

A Stronger Programme

The stronger the foundation of an AML model risk management programme, the more effectively and efficiently the risk will be managed. Adherence to the guidelines described here creates consistency throughout departments, functions, and the activities that are critical to providing accurate and timely information to senior management, the board, and regulators; for example in relation to the number of SARs filed. The other components of a holistic AML model risk management framework, outlined in regulatory guidance, will be the subject of future posts.